Sometimes you know the answer, you see the answer, you even have the answer… but you don’t accept the answer until you learn the hard way.

That was me with stock investing.

I’ve been casually investing for over a decade, but only recently started to take it seriously.

My older sister—a former investment banker who retired at 30—is living proof of what long-term investing can do. She paid off multiple homes, secured her kid’s college fund, and has been nagging me since I graduated almost 20 years ago to invest every penny. But I didn’t listen.

I thought I could beat the market by building businesses. I told her, “10% a year is nice, but I can 2x my money with the right startup.” And sometimes I did. But sometimes I lost money—and other times, I lost even more than I put in. Which breaks Warren Buffett’s #1 rule: Don’t lose money.

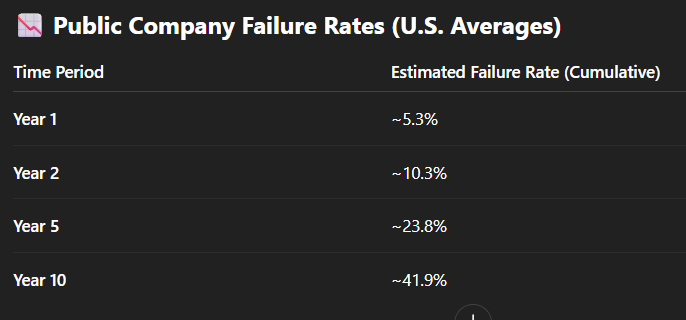

And when it come’s to losing money. A public company is 4x less likely to fail in it’s first year versus a restaurant, and 2x as likely to fail over 10 years.

This pretty much tracks with my record:

Chicken & Rice

#1 Bedford St: success

#2 Medford: closed

#3 Allston: closed

#4 DTC: still open

#5 Houston: closed

#6 Everett: still open but struggling

Seoul Kitchen

#1: success

#2: success

Other restaurants, Vuji & China Moon, closed under a year. Which means over 10 years, yes probably 90% of them will have closed.

In the past year alone, I’ve lost over $150,000 in restaurants. If I’d simply left that money in the market, it could grow to $1.5M over 30 years.